41 ytm for coupon bond

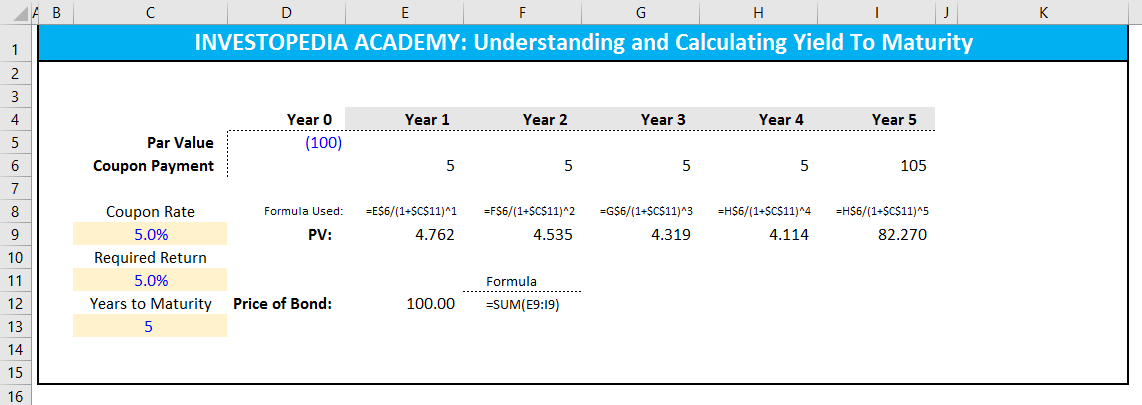

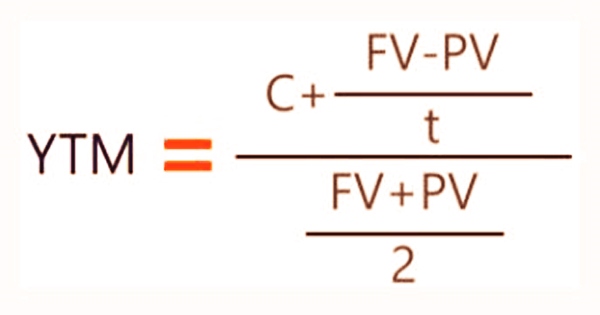

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond Mathematically, the coupon bond formula is represented as, Coupon Bond = C * [ (1- (1 + YTM))^ (-n))/ YTM ]+ [P/ (1 + YTM)^n] where, C = Coupon payment P= Par value YTM = Yield to maturity n = Number of periods until maturity Examples Following examples are given below: Example #1 Yield to Maturity (YTM): Formula and Excel Calculator Annual Coupon (C) = 3.0% × $1,000 = $30 Yield to Maturity (YTM) Example Calculation With all required inputs complete, we can calculate the semi-annual yield to maturity (YTM). Semi-Annual Yield-to-Maturity (YTM) = [$30 + ($1,000 - $1,050) / 20] / [ ($1,000 + $1,050) / 2] Semi-Annual YTM = 2.7%

Find Bond YTM - annual vs semiannual coupons - YouTube About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features Press Copyright Contact us Creators ...

Ytm for coupon bond

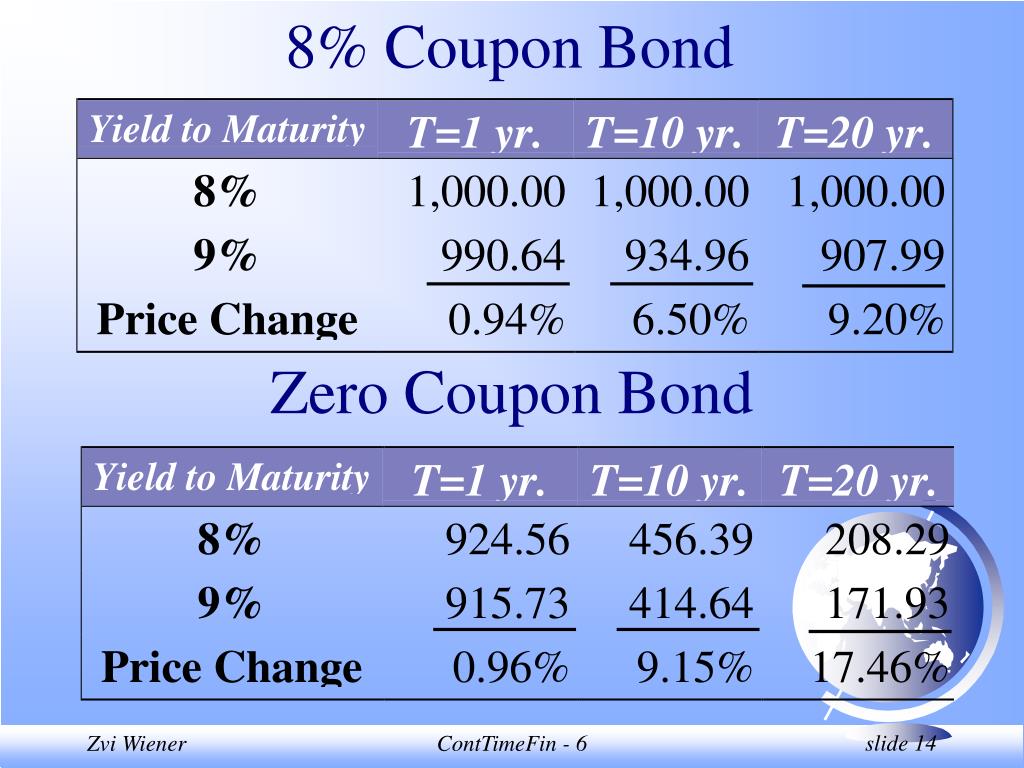

How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The yield-to-maturity is the implied market discount rate given the price of the bond. Relationship with bond's price. A bond's price moves inversely with its YTM. An increase in YTM decreases the price and a decrease in YTM increases the price of a bond. The relationship between a bond's price and its YTM is convex. Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Ytm for coupon bond. How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... Yield to Worst (YTW): Formula and Bond Excel Calculator Yield to Maturity (YTM): "= YIELD (12/31/2021, 12/31/2031, 6%, Bond Quote, 100, 1)" By contrast, the YTC switches the "maturity" to the first call date and "redemption" to the call price, which we'll assume is set at 104. Solved What is the YTM of a twenty-year zero coupon bond | Chegg.com Expert Answer. 5.54% Face value of bond is $ 1000 which is paid at the end of maturit …. View the full answer. What is the YTM of a twenty-year zero coupon bond which is currently selling for $340? 5.85% 5.75% 5.54% 5.68%. Yield to Maturity Calculator | Calculate YTM The YTM can be thought of as the rate of return on a bond. If you hold the bond to maturity after buying it in the market and are able to reinvest the coupons at the YTM, the YTM will be the internal rate of return (IRR) of your bond investments.

Yield to Maturity (YTM) - Overview, Formula, and Importance The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds [ edit] Example 1 [ edit] Consider a 30-year zero-coupon bond with a face value of $100. If the bond is priced at an annual YTM of 10%, it will cost $5.73 today (the present value of this cash flow, 100/ (1.1) 30 = 5.73). Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. Yield to Maturity (YTM) - Definition, Formula, Calculations Use the below-given data for calculation of YTM We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80. Yield to Maturity (Approx) = (80 + (1000 - 94) / 12 ) / ( (1000 + 940) / 2) YTM will be - Example #2 FANNIE MAE is one of the famous brands that are trading in the US market.

Yield to Maturity (YTM) Definition - Investopedia Because YTM is the interest ratean investor would earn by reinvesting every coupon payment from the bond at a constant interest rate until the bond's maturity date, the present value of all the... Yield to Maturity - YTM vs. Spot Rate. What's the Difference? The spot interest rate for a zero-coupon bond is calculated as: Spot Rate= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 The formula for the spot rate given above only applies to... Yield to Maturity (YTM) - Meaning, Formula & Calculation Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM. Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Current Yield vs. Yield to Maturity - Investopedia For example, if an investor buys a 6% coupon rate bond (with a par value of $1,000) for a discount of $900, the investor earns annual interest income of ($1,000 X 6%), or $60. The current yield is...

Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments. r = discount rate (the yield to maturity) F = Face value of the bond. n = number of coupon payments.

How to Calculate Yield to Maturity: 9 Steps (with Pictures) , where, P = the bond price, C = the coupon payment, i = the yield to maturity rate, M = the face value and n = the total number of coupon payments. If you plug the 11.25 percent YTM into the formula to solve for P, the price, you get a price of $927.15. A lower yield to maturity will result in a higher bond price.

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A...

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Yield to Maturity (YTM): Formula, Meaning & Calculation In the case of a Bond, YTM is defined as the total rate of return that a Bond Holder expects to earn if a Bond is held till maturity. The YTM formula for a single Bond is: Yield to Maturity = [Annual Interest + { (FV-Price)/Maturity}] / [ (FV+Price)/2] In the above formula, Annual Interest = Annual Interest Payout by the Bond.

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate. The zero coupon bond formula is as follows: Yield to Maturity Calculator

The Returns on a Bond - YTM - The Fixed Income The yield to maturity of a bond might not be the same as the coupon, or interest rate paid out on the bond. ... price considers that between the current rate of 8% and the coupon of 10% there are Rs. 20 extra that will be paid as a coupon on the bond, and Rs. 13.42 less than the amount paid now that is received on maturity. ...

How to calculate YTM in Excel | Basic Excel Tutorial Steps to follow when calculating YTM in Excel using =RATE () Let us use these values for this example. You can replace them with your values. Face value =1000 Annual coupon rate =10% Years to maturity =10 Bond price =887. Now let us create the YTM using these values. 1. Launch the Microsoft Excel program on your computer. 2.

Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

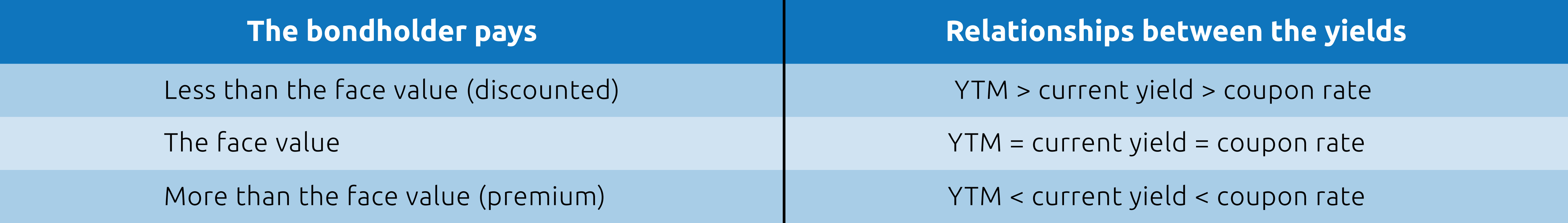

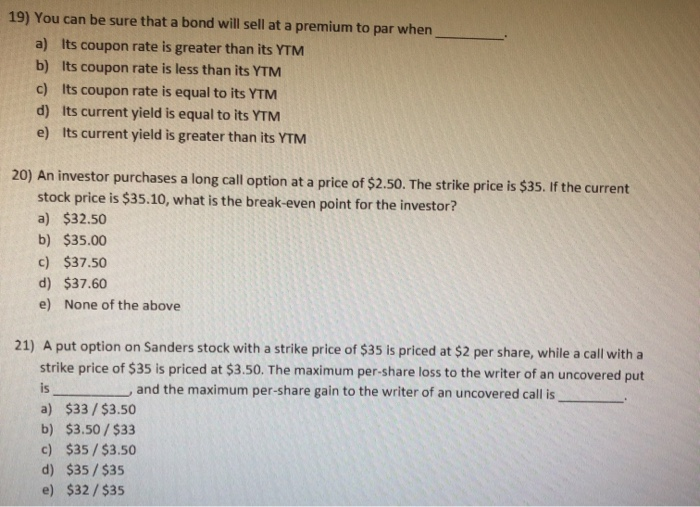

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The yield-to-maturity is the implied market discount rate given the price of the bond. Relationship with bond's price. A bond's price moves inversely with its YTM. An increase in YTM decreases the price and a decrease in YTM increases the price of a bond. The relationship between a bond's price and its YTM is convex.

How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

/GettyImages-810720992-f4dcb14dc2674174a84be79d0d538f85.jpg)

Post a Comment for "41 ytm for coupon bond"