45 coupon interest rate definition

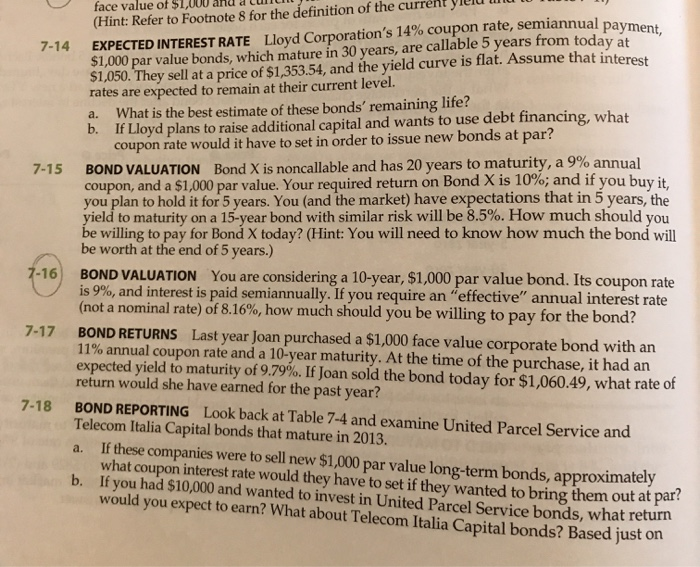

Interest Rate Swaps Explained – Definition & Example - Money … Web14.09.2021 · Interest rate swaps are traded over the counter, and if your company decides to exchange interest rates, you and the other party will need to agree on two main issues: Length of the swap . Establish a start date and a maturity date for the swap, and know that both parties will be bound to all of the terms of the agreement until the contract expires. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Coupon Equivalent Rate (CER) Definition - Investopedia Coupon Equivalent Rate - CER: A alternative calculation of coupon rate used to compare zero-coupon and coupon fixed-income securities. Formula:

Coupon interest rate definition

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) WebInterest Rate Risk: Involves the greatest level of Interest Rate Risk due to the high duration of the Bond Duration Of The Bond Duration is a risk measure used by market participants to measure the interest rate sensitivity of a debt instrument, e.g. a Bond. It tells how sensitive is a bond with respect to the change in interest rates. This ... Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ...

Coupon interest rate definition. Coupon rate financial definition of Coupon rate - TheFreeDictionary.com The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons. What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. Interest Rate Sensitivity Definition - Investopedia Web12.12.2020 · Interest rate sensitivity is a measure of how much the price of a fixed-income asset will fluctuate as a result of changes in the interest rate environment. Securities that are more sensitive have ... Zero-Coupon Bond - Definition, How It Works, Formula Web28.01.2022 · To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and; n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. In reality, zero-coupon ...

What is a Coupon Payment? - Definition | Meaning | Example WebWhat is the definition of coupon payment? Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond. It was also used as … Interest Rate Risk Definition and Impact on Bond Prices Web31.12.2021 · Interest Rate Risk: The interest rate risk is the risk that an investment's value will change due to a change in the absolute level of interest rates, in the spread between two rates, in the shape ... Learn About Coupon Interest Rates | Chegg.com The coupon interest rate indicates the annual interest rate paid by the issuer of the bond, taking into consideration its face value. The coupon interest rate is visualized in percentage form. The coupon rate is calculated by dividing annual coupon payments with the face value of the bond. Coupon Interest | Insurance Glossary Definition | IRMI.com Coupon Interest — the rate of interest paid to the holders of a bond. This rate can be either a floating variable or fixed rate. Often, zero coupon bonds are issued that pay no interest until the bond is redeemed to guarantee repayment of the principal of the bond or specific tranche.

Discount Rate vs Interest Rate | 7 Best Difference (with ... - EDUCBA WebWhereas Interest rate has a narrow definition and usage, however, multi things are to consider before determining the interest rates. In some cases, you have to pay to borrow money then it is a direct financial cost. In other cases, when you invest money in an investment, and the invested money cannot be utilized in anything else, then there is an … Coupon Rates financial definition of Coupon Rates - TheFreeDictionary.com The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons. Coupon Rate: Definition, Formula & Calculation - Study.com Coupon rate, as used in fixed-income investing, refers to the annualized interest with respect to the initial loan amount. Learn the definition of and formula for coupon rate, and understand the ... Coupon Definition & Meaning - Merriam-Webster The meaning of COUPON is a statement of due interest to be cut from a bearer bond when payable and presented for payment; also : the interest rate of a coupon. How to use coupon in a sentence.

Coupon Rate Calculator | Bond Coupon Web15.07.2022 · Before we dive into explaining the coupon rate definition, we need to first discuss what a bond is. For many business entities out there, issuing bonds is the easiest way to acquire money from investors or the market. We call it debt financing. Investing in bonds is equivalent to loaning out money to the entity that issues them. Hence, like any …

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms...

Coupon interest rate financial definition of coupon interest rate coupon interest rate the INTEREST RATE payable on the face value of a BOND. For example, a £100 bond with a 5% coupon rate of interest would generate a nominal return of £5 per year. See EFFECTIVE INTEREST RATE. Collins Dictionary of Economics, 4th ed. © C. Pass, B. Lowes, L. Davies 2005 Want to thank TFD for its existence?

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The coupon rate is the annual amount of interest that the owner of the bond will receive. To complicate things the coupon rate may also be referred to as the yield from the bond. Generally, a bond...

Meaning Of Coupon Rate - Verified Sep 2022 Coupon rate financial definition of Coupon rate. The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a …

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean?

Interest - Wikipedia WebIn finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct from a fee which the borrower may pay the lender or some third party. It is also distinct from dividend which is paid by a …

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its entire maturity. Prevailing interest rates may rise or...

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ...

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) WebInterest Rate Risk: Involves the greatest level of Interest Rate Risk due to the high duration of the Bond Duration Of The Bond Duration is a risk measure used by market participants to measure the interest rate sensitivity of a debt instrument, e.g. a Bond. It tells how sensitive is a bond with respect to the change in interest rates. This ...

/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Post a Comment for "45 coupon interest rate definition"