44 suppose you bought a bond with an annual coupon of 7 percent

CHAPTER 7 An investor is considering buying one of two bonds issued by Carson City Airlines. Bond A has a 7 percent annual coupon, whereas Bond B has a 9 percent annual coupon. Both bonds have 10 years to maturity, face values of $1,000, and yields to maturity of 8 percent. Suppose you bought a bond with an annual coupon of Need more help! Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year?

Chapter 7, Interest Rates and Bond Valuation ... - Numerade a. Suppose that today you buy a 9 percent coupon bond making annual payments for $\$ 1,150 .$ The bond has 10 years to maturity. What rate of return do you expect to earn on your investment? b. Two years from now, the YTM on your bond has declined by 1 percent, and you decide to sell. What price will your bond sell for?

Suppose you bought a bond with an annual coupon of 7 percent

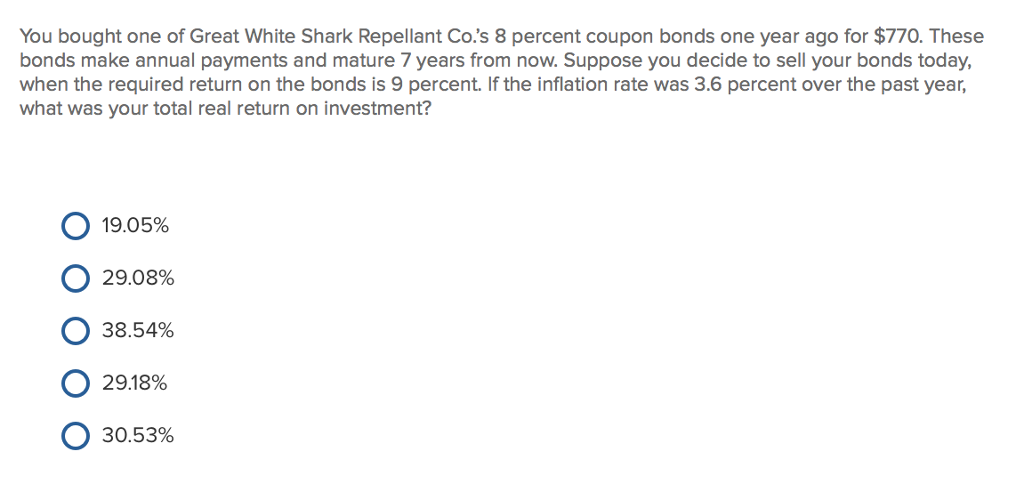

You bought one of Glenelm Co.’s 8 percent coupon ... You bought one of Glenelm Co.â s 8 percent coupon bonds one year ago for$1,030. These bonds make annual payments and mature in six years from now. Suppose you decide to sell your bonds today, when the required return on the bonds is 7 percent. Assume the face value of the bond is $1,000. Answered: 4. Calculating Returns [LO1] Suppose… | bartleby 4. Calculating Returns [LO1] Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (PDF) General Mathematics Learner's Material Department of ... This learning resource was collaboratively developed and reviewed by educators from public and private schools, colleges, and/or universities. We encourage teachers and other education stakeholders to email their feedback, comments and

Suppose you bought a bond with an annual coupon of 7 percent. fin 300 Flashcards | Quizlet Bond prices. The Timeberlake-Jackson Wardrobe Co. has 7 percent coupon bond on the market with nine years left to maturity. The bonds make annual payments. If the bond currently sells for $1,038.50, what is its YTM? Bond Yields. Merton Enterprises has bonds on the market making annual payments, with 12 years to maturity, and selling for $963. Suppose you bought a bond with an annual coupon rate of 7 ... Answer of Suppose you bought a bond with an annual coupon rate of 7 percent one year ago for $860. The bond sells for $890 today. a. Assuming a $1,000 face... Chapter 10 Finance Flashcards - Quizlet To calculate the dollar return, we multiply the number of shares owned by the change in price per share and the dividend per share received. The total dollar return is: Dollar return = 270 ($82.84 - 76.33 + 1.45) Dollar return = $2,149.20 Suppose you bought a bond with an annual coupon rate of 7.8 percent one year ago for $901. Answered: Suppose you bought a $1,000 face value… | bartleby Suppose you bought a $1,000 face value bond with a coupon rate of 5.6 percent one year ago. The purchase price was $987.50. You sold the bond today for $994.20. If the inflation rate last year was 2.6 percent, what was your exact real rate of return on this investment?

Calculating returns suppose you bought a bond with an 3. Calculating Returns Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? Answered: Suppose you bought a bond with an… | bartleby Suppose you bought a bond with an annual coupon rate of 7.8 percent one year ago for $901. The bond sells for $934 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. Suppose you bought a bond with an annual coupon of 7 percent Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. Subject: Business Price: 2.87 Bought 7. Share With. Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. Success Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

Solved Calculating Returns [LO1] Suppose you bought a bond ... Calculating Returns [LO1] Suppose you bought a bond with an annual coupon of 7 percent one year ago for $970. The bond sells for $940 today. a. Assuming a $1,000 face value, what was you total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? c. If the Finance Unit 8 Flashcards - Quizlet The bond in this question has a coupon rate of 10%. This means that the bond promises to pay 10% interest per year. As bonds are set a face values of $1,000, the annual coupon paid would be 10% x $1,000 = $100. When a bond is first issued, it is generally issued at par, which means Market value = Face value RR/YTM = Coupon rate. Suppose you bought a bond with an annual coupon rate of 4 ... answered • expert verified Suppose you bought a bond with an annual coupon rate of 4.2 percent one year ago for $900. The bond sells for $950 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? Calculating Returns [LO1 ] Suppose you bought a bond with ... [LO1 ] Suppose you bought a bond with an annual coupon of 7 percent one year ... What was your total nominal rate of return on this investment over the ...

Solved Suppose you bought a bond with an annual coupon rate Suppose you bought a bond with an annual coupon rate of 5.6 percent one year ago for $800. The bond sells for $865 today. a. Assuming a $1,000 face value, ...

Capital gains yield formula excel - animadigomma.it Microsoft: Yield. 59 percent--which is the annual yield to maturity of this bond. The bonds have an 8% annual coupon rate and were issued 1 year ago at their par value of How to make a dividend tracking spreadsheet template in Excel & Google Sheets. 10:19 Part 3: How to Extend the Formula to Yield to Call and Yield to Put.

Compound Interest Questions and Answers | Study.com Suppose you invest $10,000 at an annual interest rate of 12%. Each of the following cases, calculate the final amount you will have in the account after 20 years. (a) It is invested with a basic in...

W4 Chapters 10-12.xlsx - Suppose a stock had an initial price of $60 per share paid a dividend ...

Essay Fountain - Custom Essay Writing Service - 24/7 ... Custom Essay Writing Service - 24/7 Professional Care about Your Writing +1(978) 822 0999. Essay Fountain. Your number one essay writing service.

Suppose you bought a bond with an annual coupon of 7 ... Answer of Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value,...

Answered: Suppose you bought a bond with an… | bartleby Suppose you bought a bond with an annual coupon rate of 7.1 percent one year ago for $894. The bond sells for $920 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b.

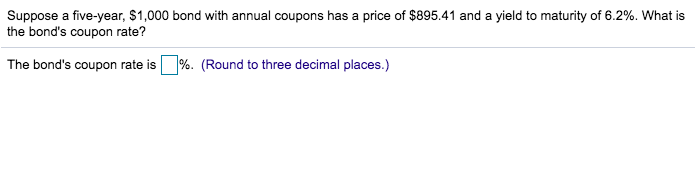

HW 7 Flashcards | Quizlet Suppose a German company issues a bond with a par value of €1,000, 23 years to maturity, and a coupon rate of 3.8 percent paid annually. If the yield to maturity is 4.7 percent, what is the current price of the bond?

Solved Suppose you bought a bond with an annual coupon rate Suppose you bought a bond with an annual coupon rate of 7 percent one year ago for $860. The bond sells for $890 today. a. Assuming a $1,000 face value, ...

Post a Comment for "44 suppose you bought a bond with an annual coupon of 7 percent"